I recently watched a documentary about Bill Gates on Netflix, and what struck me most was that he did not become one of the richest people in the world thanks to luck or receiving huge sums of money. He literally reads about 8 books while traveling, he can read 150 pages per hour and he LIKES to study. One of his close friends said: “Bill always knows more about any topic than the person with whom he talks about it.” What does this have to do with trading? All…

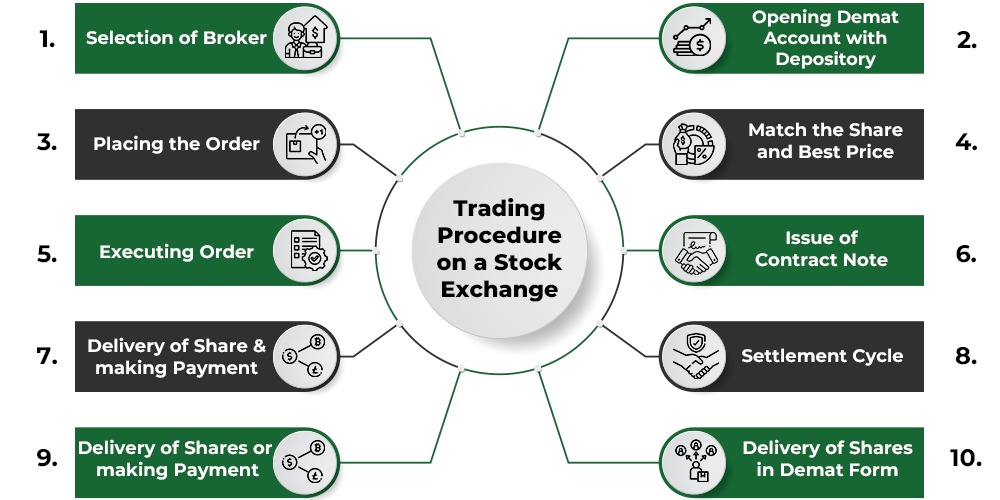

The key to success in trading is to become a profitable trader by learning how to trade correctly and consistently following an effective trading procedure in a disciplined manner until it becomes a habit.

Here’s what you need to know about trading procedures: Trading procedures are the real key to success in the market. There is no magic indicator or algorithmic trading robot that could easily turn you into a profitable trader. Just as Bill Gates’ routine has led to insane financial success every day for years, so has your trading routine. However, if you don’t have or you stick to the wrong routine, you will never become a successful trader. Bill Gates could have been lying down and watching TV. eating cheetos all day instead of reading everything he could get his hands on about business and programming? Safe. And you’d never know who Bill Gates was if he did.

There is a “fire” in Bill Gates; a desire to learn, to grow, to be more, which seemed to be partly innate and partly developed in his childhood. I can’t provide it to you, you have to develop it if you don’t have it. But I CAN give you the basis, so to speak, the “keys” to the “kingdom”, but you must have the right trading mindset to be able to “turn the key”. So, when you are ready, keep reading and learn more about the daily trading procedure that has worked for me in the market for the past 10+ years….

The main components of my daily trading routine

My trading procedure involves much less interaction with the market than many other traders. It works for me, and I firmly believe it will work for you for the following reasons: less stress, less time to ruin your trades with excessive involvement, low trading frequency, discipline, you only control yourself and don’t try to control the market.

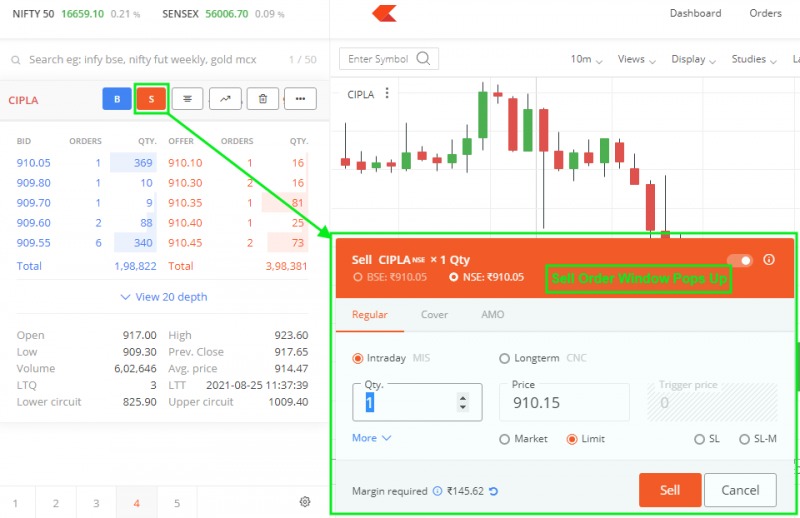

My general approach is to focus on the data at the end of the day, which means I focus on the time frame of the daily chart and usually wait until the market closes every day to really sit down and take a close look at the markets on my watch list. This is what I call a part-time trading procedure, and its advantage is not only that you have less screen time (so that you can do other things), but also that you spend less time looking at charts. will actually improve your trading performance in the long run.

First, I take a weekly overview: I look at the weekly time frame of the chart, mark key levels, get an idea of short- and long-term trends, and note any obvious/major price action reversal signals.

Next, we will look at the time frame of the daily chart. Basically, we are looking for key support and resistance levels, current and recent market conditions: trending or sideways? And last but not least, let’s look at the PRICE ACTION; any signals that could form near key levels? Any signals that were formed after the rollback to the level? Note: The levels can be horizontal support or resistance levels, exponential moving averages of the EMA, or even tracking levels of 50%.

Well, since this is just a blog post, I need to study some of the more detailed topics like money management, trading psychology, stop loss placement, etc. Now that this is just a blog post, I need to study some of the more detailed topics like money management, psychology trading, stop loss placement, etc. are “embellishing”, but you can follow the links I just provided to learn a little more and, of course, these topics will be discussed in much more detail in my professional trading course.

What is the essence of all this? From my entire trading process?

Plain. It is a habit of routine discipline, or RDH.

Let me explain this to you (it’s very important) – Remember my mention of Bill Gates earlier?.

Bill Gates probably has better habits than you (or me, to be honest), as does Warren Buffett. The world’s elite, those men and women who have accumulated a huge fortune or otherwise succeeded in their craft, have achieved this through a routine that requires discipline, which has turned into habits. Dedication is unrealistic, but honestly, it’s what you need. Bill Gates reads so many books not because he hates it, but because he really likes it! So, you have to really love trading, and you have to like routine and discipline if you hope to turn them into proper trading habits. The right trading habits will bring you prosperity in the markets, there is no easy way or shortcut but to TRULY love this process. And remember, I can show you my process, the one that worked for me, but you have to LOVE it, be passionate enough about the process to make it work!